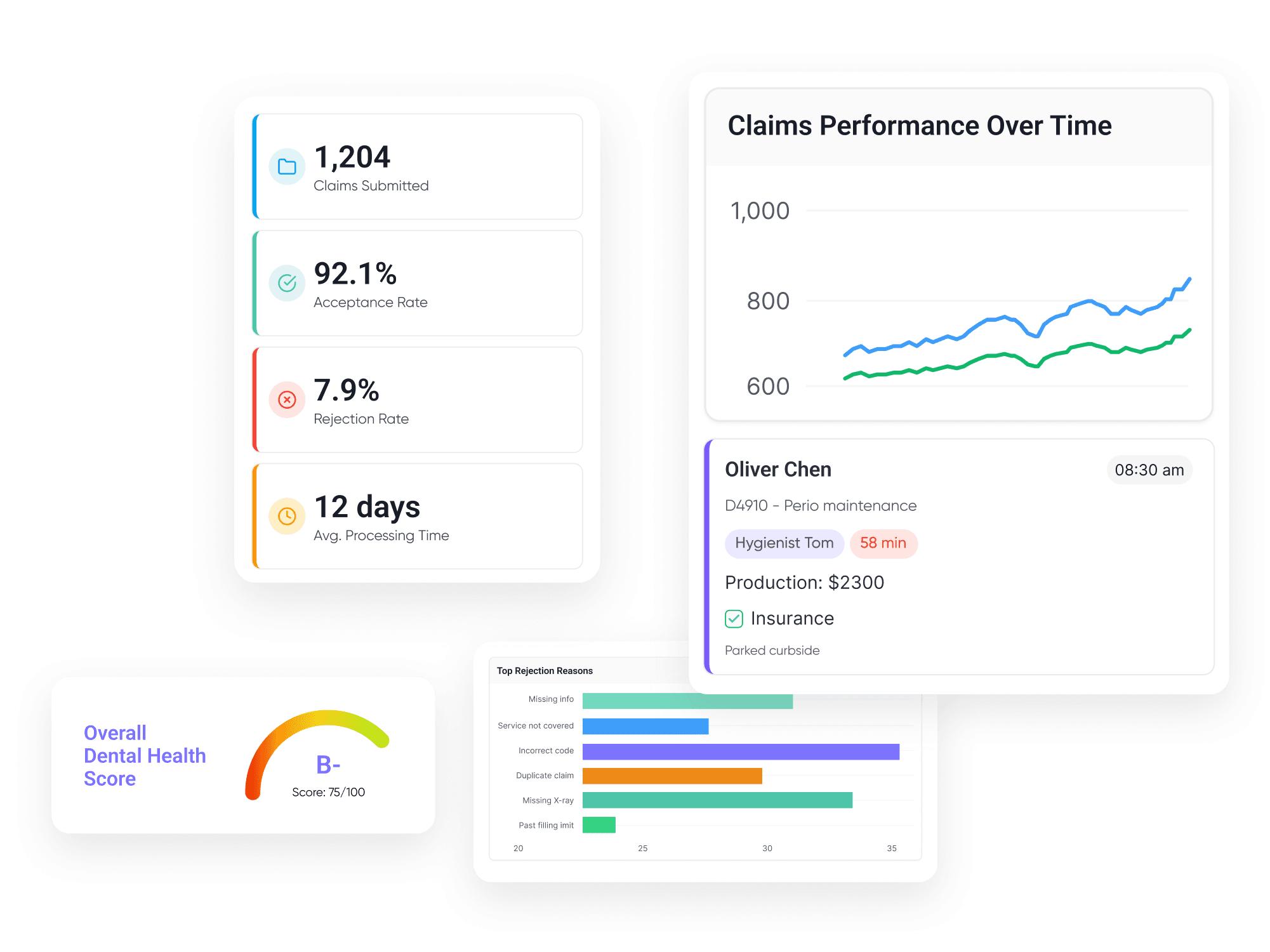

Get the Full Insurance Breakdown, Not Just "Active" Status

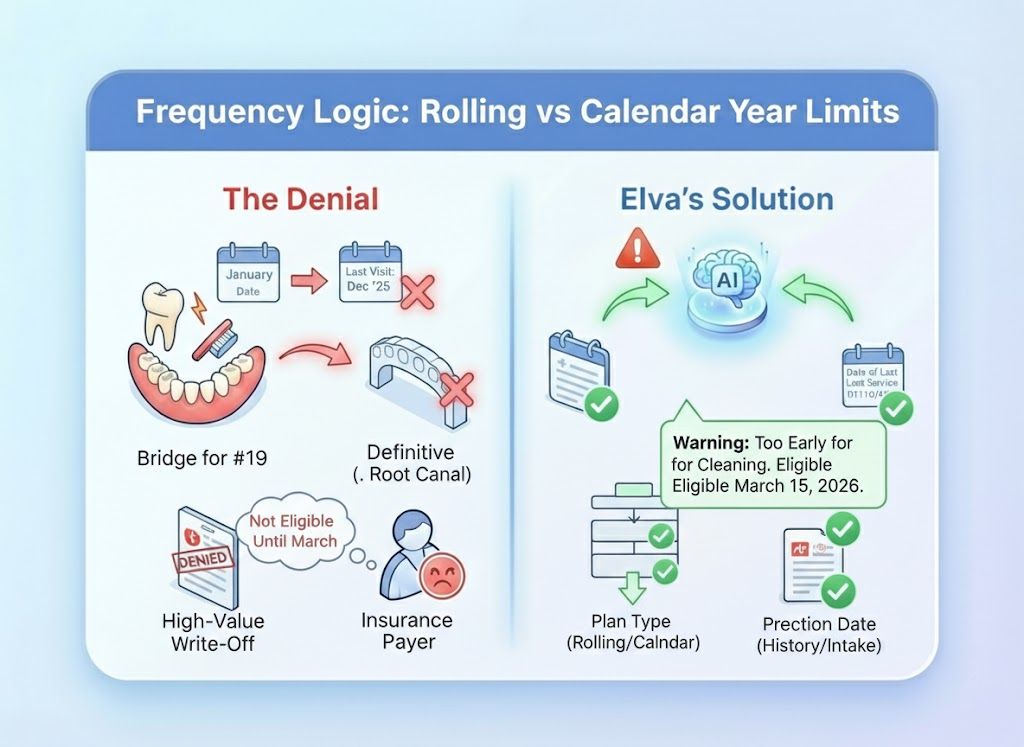

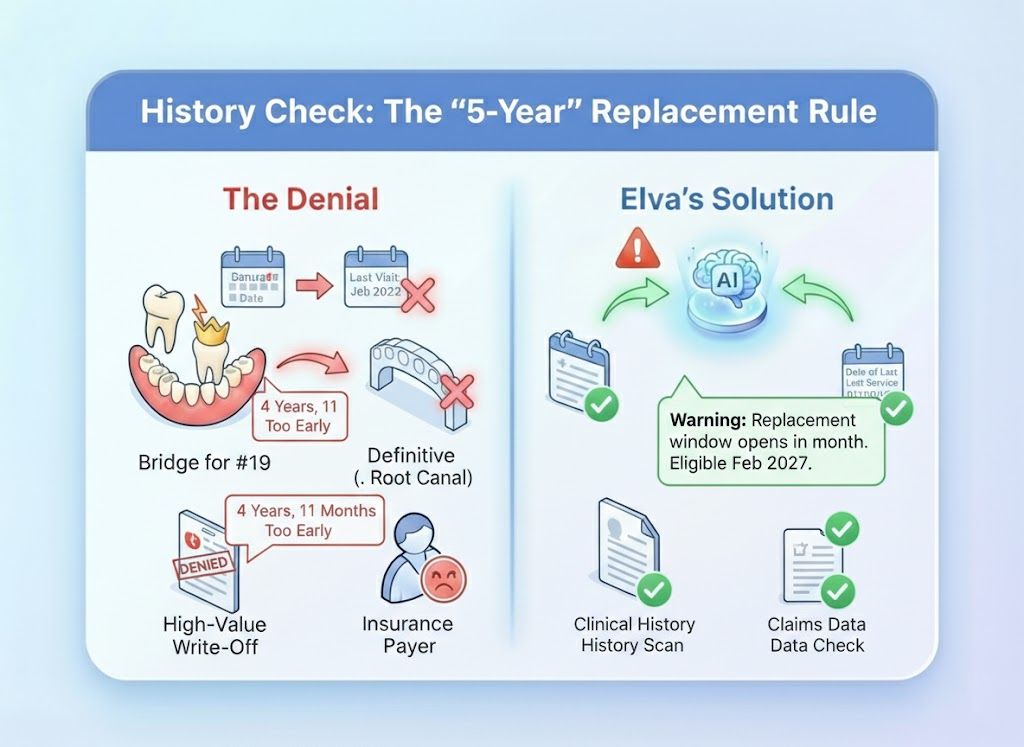

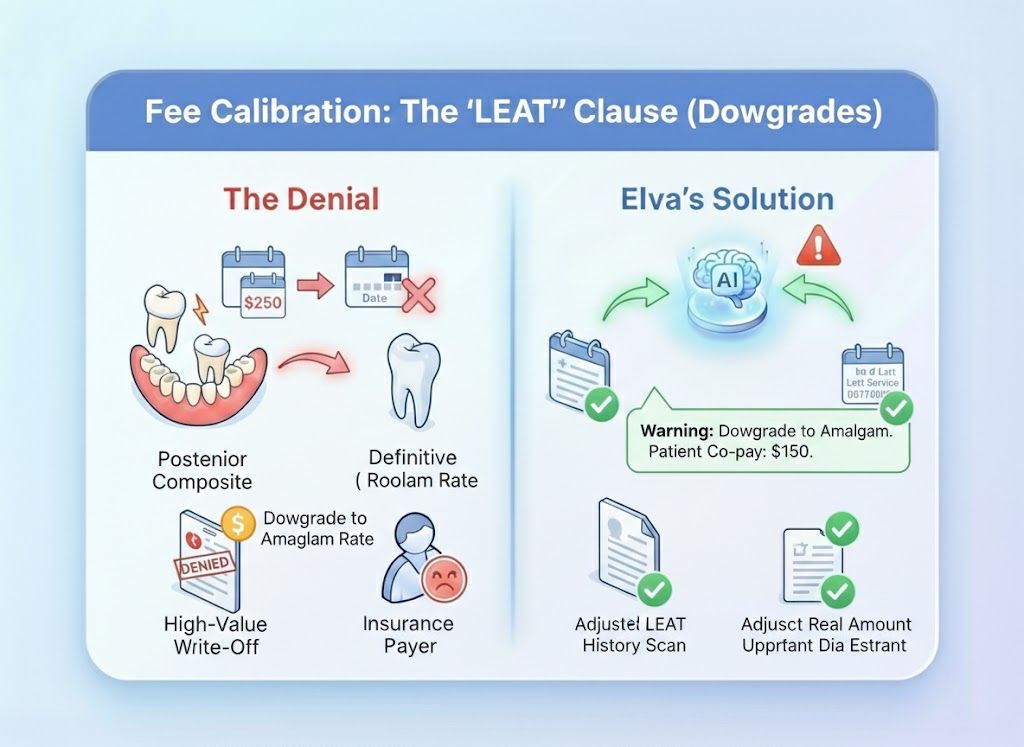

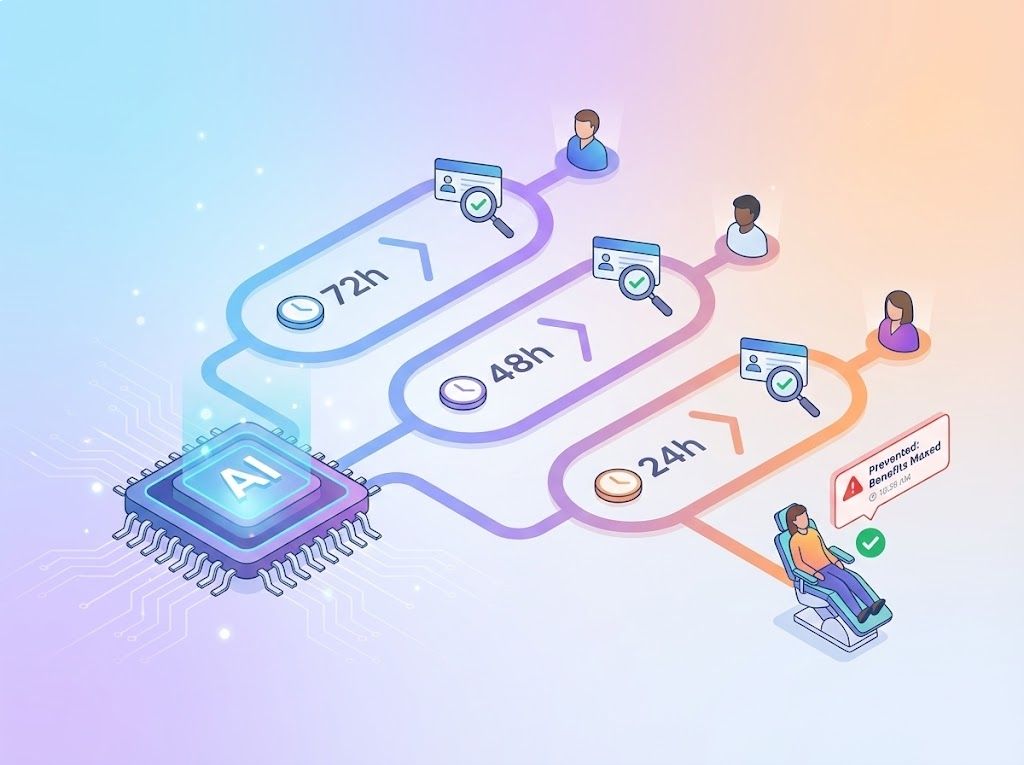

Stop relying on simple "Green Checks" that only tell you a policy exists. Elva verifies the entire contract. It reads the fine print for hidden frequency limits, waiting periods, and replacement clauses at 72, 48, and 24 hours before the appointment, ensuring your treatment plan estimates are accurate to the penny.

72/48/24h Auto-Verification

Checks benefits three times before the visit to catch last-minute coverage changes or lost eligibility.

True PMS Write-Back

Writes plan details, fee schedules, and subscriber data directly into your chart. No manual entry needed.

Family Max Tracking

Monitors shared annual maximums to prevent one family member from accidentally draining the whole fund.

Detailed Code Breakdown

Checks eligibility for specific high-risk codes like Nightguards and Implants, not just general categories.

Don't Just Read Data. Write It.

The Old Way (Portal Surfing): Staff log into 5 different portals, download PDF summaries, and manually type "100/80/50" into the patient’s file. They miss the nuanced clauses (like "Missing Tooth") because they don't have time to read the 20-page document. The Elva Way (True Write-Back): Elva doesn't just read the data; it writes it. It updates the Fee Schedule, Coverage Table, and Payment Logic directly inside your PMS (Dentrix/Open Dental/Eaglesoft). It corrects patient demographics, fixes typos, and sets up the "Subscriber ID" perfectly so your team never has to touch the insurance setup.

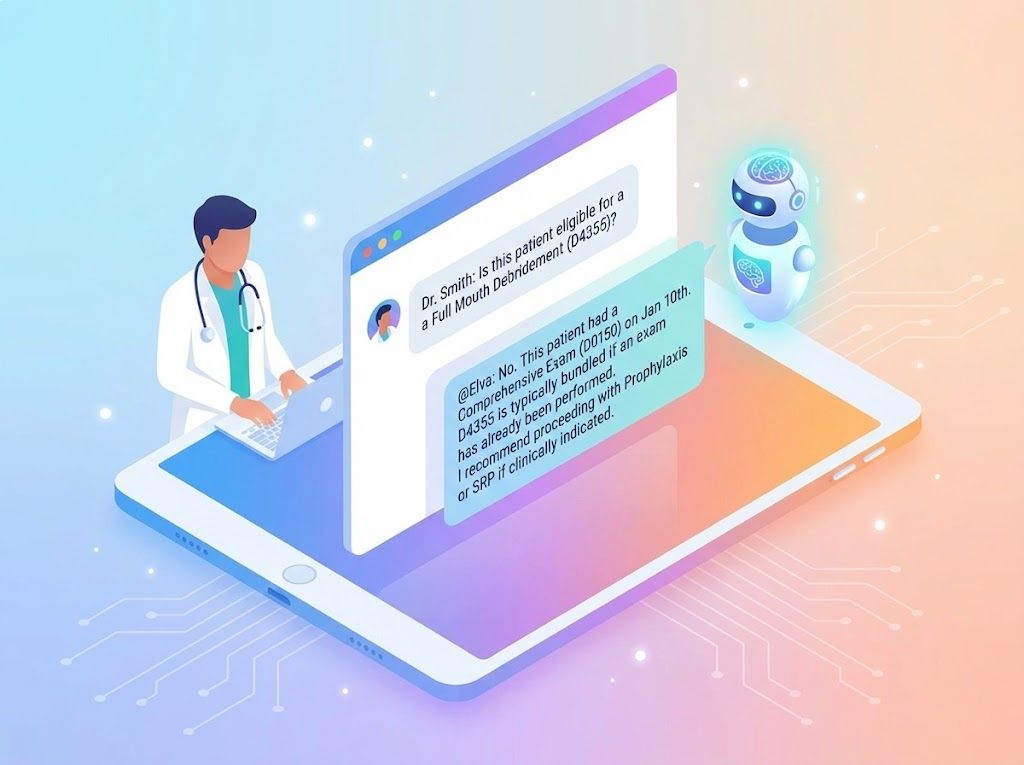

Don't Run a Report. Just ask in the Chat

Your clinical team can use Elva Chat to get instant answers about coverage without leaving the operatory or bugging the front desk. Dr. Smith: "Is this patient eligible for a Full Mouth Debridement (D4355)?" @Elva: "No. This patient had a Comprehensive Exam (D0150) on Jan 10th. D4355 is typically bundled if an exam has already been performed. I recommend proceeding with Prophylaxis or SRP if clinically indicated."

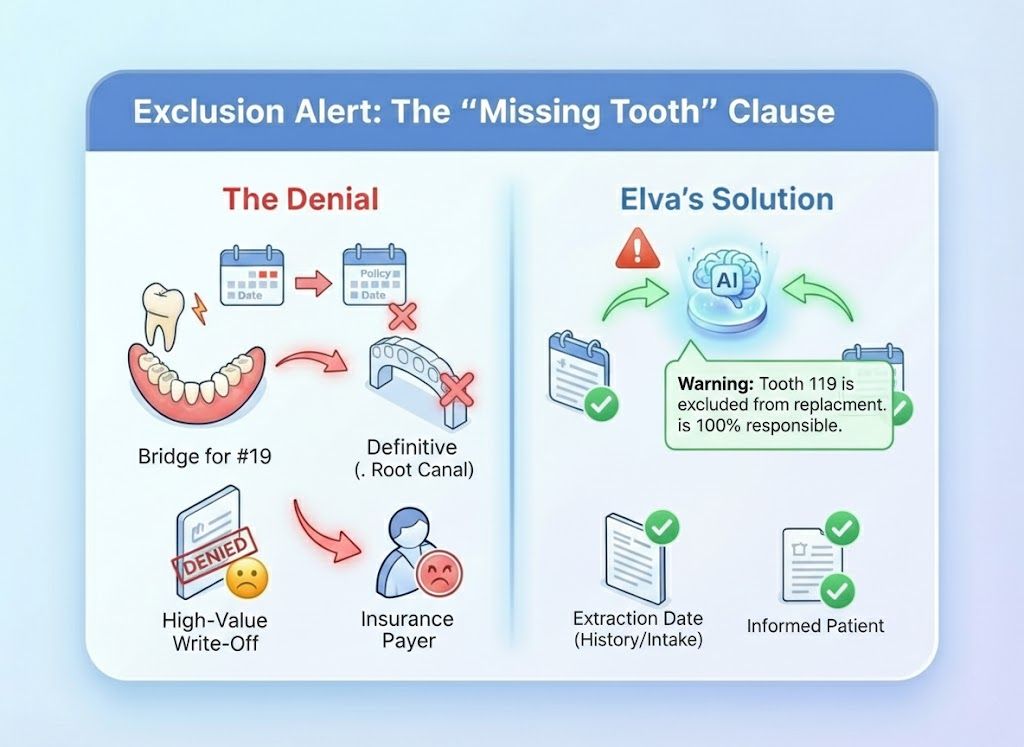

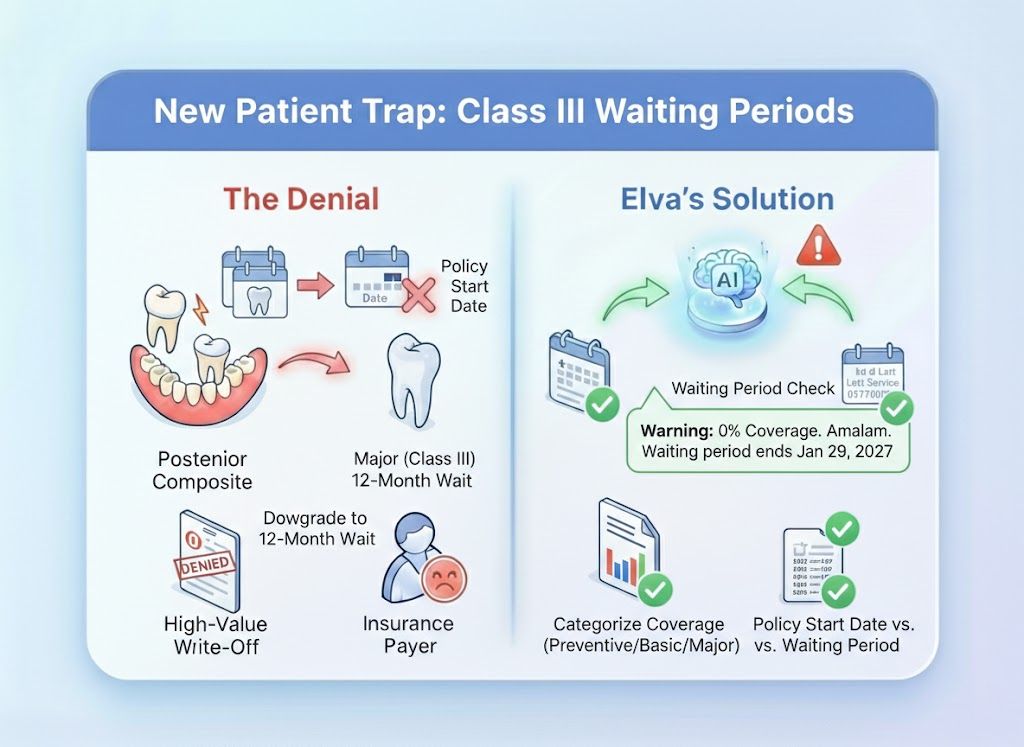

"Active" Status ≠ Payable Claim

A green checkmark only means the policy exists. It doesn't tell you about the Missing Tooth Clause or the 12 Month Waiting Period that will deny your $3,000 bridge. Elva doesn't just Verify; it gets the full Breakdown.

The Engine That Powers Your Front Desk

Automated workflows that turn raw data into actionable financial clarity, giving your team the answers they need without the manual research.

72/48/24h Verification Loop

Visual Data Capture (OCR)

Family Maximum Tracking

The "Morning Huddle" Insight

The "Fine Print" Analysis Engine

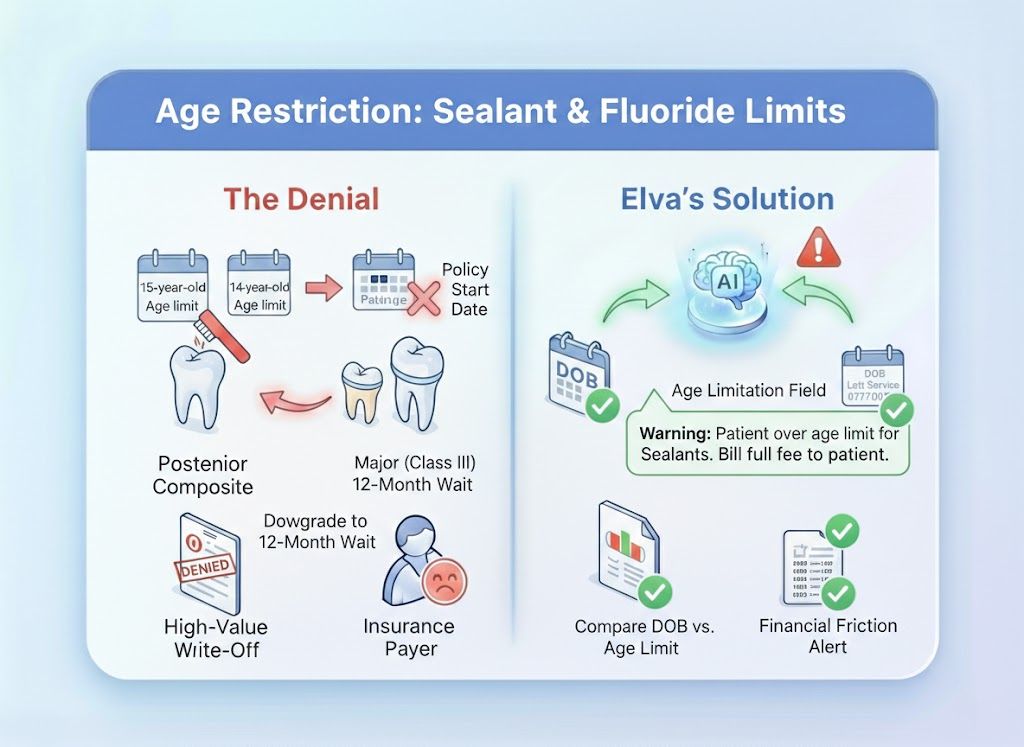

Eligibility is more than just "Active" or "Inactive." Elva analyzes the complex logic behind the claim, scanning for specific clauses like "Missing Tooth," "Waiting Periods," "Age Limits," and "Downgrades", to catch the hidden exclusions that cause 80% of denials.

Eliminate the "Surprise Bill"

See the hidden exclusions and frequency limits that standard eligibility checks miss. Eliminate surprises and protect your production.

Schedule a Demo